Tiktok Pixel can easily bring visitors to a website. This may not be known by many people. So, if you are a blogger, entrepreneur, or other business person, it is very important to know this. As we know, currently Tiktok is not only a social media for entertainment, but can also be used to advertise […]

Category Archives: Software

Windows 10 Mac are two different operating systems, where Mac is the operating system used on Apple, while Windows is used by products issued by Microsoft. You need to know that, currently Windows 10 and macOS can be installed on a MacBook or iMac, so that there will be a dual boot of Windows and […]

How to make a presentation in Canva can be done easily and quickly. Both by beginners and experts. In addition to presentations, Canva can also be used to create social media post images, blog posts, etc. And the good news is, you can use this Canva software for free. The Canva application provides more than […]

Tiktok old version or Tiktok Asia 19.5.5 has been widely searched for lately. This is quite reasonable because it is not uncommon for the latest version of an application to cause problems when installed on an old smartphone. Often the new version of the application cannot function perfectly when installed on a smartphone because the […]

There are many product marketing Power Point example templates, both online and offline. There are three things to consider before you create a sales marketing presentation PPT, including: To convey marketing strategies to team members To attract investors Or to offer marketing services to new clients (customers) You are required to be able to […]

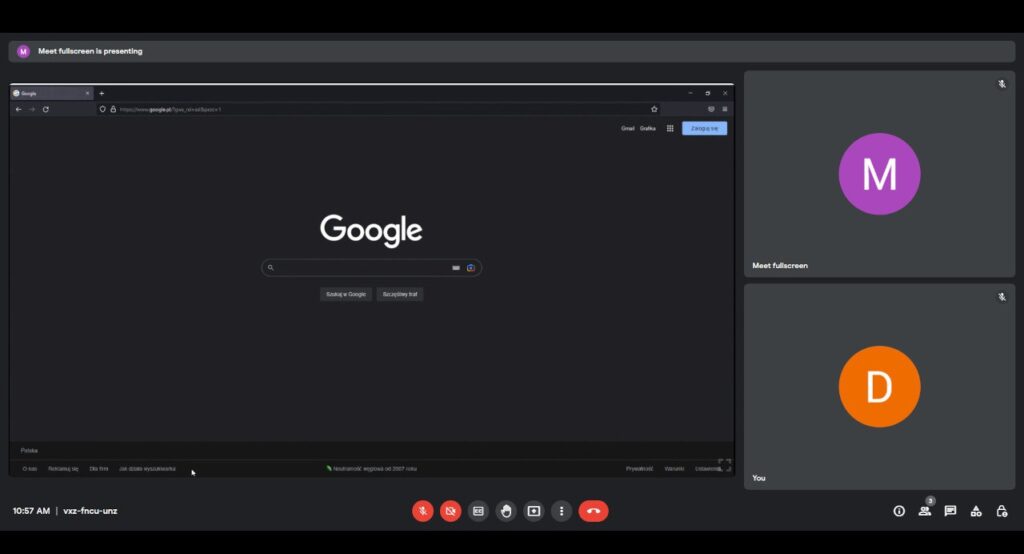

How to use Google Meet for presentations can be done easily on cellphones, PCs, or laptops. Google Meet is an application made by Google for video teleconferencing that can be used as an alternative to Zoom. This video conference application from Google can be used for free without being charged a penny. Although Zoom is […]

MSCONFIG is Microsoft System Configuration which is used to configure various settings. Windows has many small hidden utilities, and this is not visible in the Control Panel, one of the tools used since Windows 98 is MSCONFIG to change and configure system settings. Well, in this article we will show you how to use and access […]

Linux Operating System is a UNIX-based OS developed by Open Source and Freeware. So most Linux OS can be used for free. All devices such as smartphones, laptops, and computers will not be able to run if they do not have an Operating System (OS). This Operating System must be installed on the device. An […]

The Chrome OS operating system is a Linux-based operating system introduced in July 2009 by Google Inc. Chrome OS works exclusively with web applications from the OS. If you are used to using the Chrome browser, of course you are familiar with this Chrome OS. The features and appearance of this operating system are very […]

Indonesian article spinner is a software or application that can simplify and speed up the creation of articles. As we know, in this digital era, writing is a hobby that can generate a lot of money. This can be proven by the many bloggers who earn up to hundreds of millions of rupiah every month. […]

- 1

- 2